Generally, operating activities refer to those that involve current assets and current liabilities.

STATEMENT OF CASH FLOWS SAMPLE PROBLEMS PROFESSIONAL

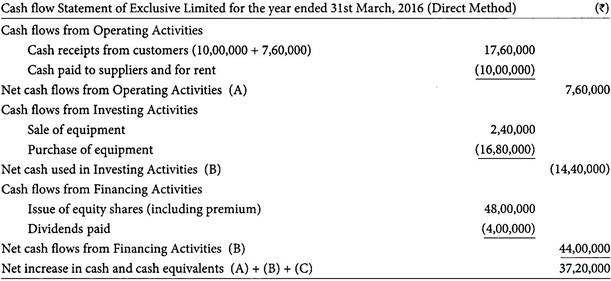

Operating activities refer to the main operations of the company such as rendering of professional services, acquisition of inventories and supplies, selling of inventories for merchandising and manufacturing concerns, collection of accounts, payment of accounts to suppliers, and others.Cash inflows and outflows are classified in three activities: operating, investing, and financing.In the illustration above, the report presents inflows and outflows of cash for 1 year, i.e. Notice that the third line is worded "For the Year Ended." This means that the information included in the report covers a span of time.The first line presents the name of the company the second describes the title of the report and the third states the period covered in the report.

A typical cash flow statement starts with a heading which consists of three lines.Cash inflows refer to receipts of cash while cash outflows to payments or disbursements. Statement of Cash Flows presents the inflows and outflows of cash in the different activities of the business, the net increase or decrease in cash, and the resulting cash balance at the end of the period.This meant that in the first year of operating, Company D did not have any cash inflow. The company was making transactions and sending customers on holidays, but as a start-up, it did not receive any money in the first year of its operation. In spite of making transactions and spending money on the production of certain goods or services, the business does not receive any money.Ĭompany D is a newly established travel agency that allows customers to book a holiday and pay after up to a year. If the time customers take to pay is too long, a business is likely to experience cash flow problems. In doing so, they allow them to pay later and deny themselves inflows of cash.Ĭustomers may often wait a week, month, year, or even longer to pay.

Many companies allow customers to buy products on credit or in instalments. Cash Flow Problems: Allowing customers to take too long to pay Thus Company C stopped making profits and started making losses, which resulted in problems with cash flow. Even though people do not buy as much cow's milk as they used to, the company still has cows that have to be fed and taken care of.Īlthough costs remained the same, the reduced demand lowered revenues, making revenues lower than costs. Recently, more and more people have gone vegan and the demand for cow's milk has decreased. The business is still spending money to operate, but it isn't earning enough money to cover its expenses.Ĭompany C produces and sells cow's milk. They make a loss, which is when over a period of time costs of production are greater than revenues.Īlthough making a loss does not necessarily have to mean that a business’s cash flow is negative, it typically leads to running out of cash. Sometimes businesses experience hard times and do not make any profit at all. Because of the quick and misguided decision, Company B experienced problems with cash flow. After several months, the costs turned out to be so high that they outweighed the revenues of the company. Unfortunately, although customers were satisfied with the quality of wipes, their high price resulted in higher costs for the company. Without any research, they made a contract with a supplier offering more expensive wipes of the best quality on the market. For this reason, managers decided to change wipes suppliers. Recently, customers have been complaining about the poor quality of wipes making trails on the car window. Lack of cash may prevent companies from buying inventory and as a result, stop their operations.Ĭompany B has a chain of car washes across the UK. Firms that do not have enough cash inflows may be unable to pay their employees. Negative cash flow might make it impossible for a company to pay for raw materials sourced from suppliers. Businesses that struggle with cash flow might be unable to pay their debts as they become due. Some common effects of cash flow problems are: If cash flow is negative, a business should refrain from spending. Effects of cash flow problemsĬash flow problems should be taken seriously and never neglected, as positive cash flow allows businesses to retain cash and spend when needed or wanted. The company experienced cash flow problems and should therefore think about the causes for this, as well as possible solutions. In 2021, the cash flow of Company A was unfortunately negative, equalling -£10,000. Negative values are marked with parentheses in the cash flow statement. Lifestyle and Technological Environment.Business Considerations from Globalisation.Risks and Rewards of Running a Business.Evaluating Business Success Based on Objectives.Information and Communication Technology in Business.Effects of Interest Rates on Businesses.Improving Employer - Employee Relations.

0 kommentar(er)

0 kommentar(er)